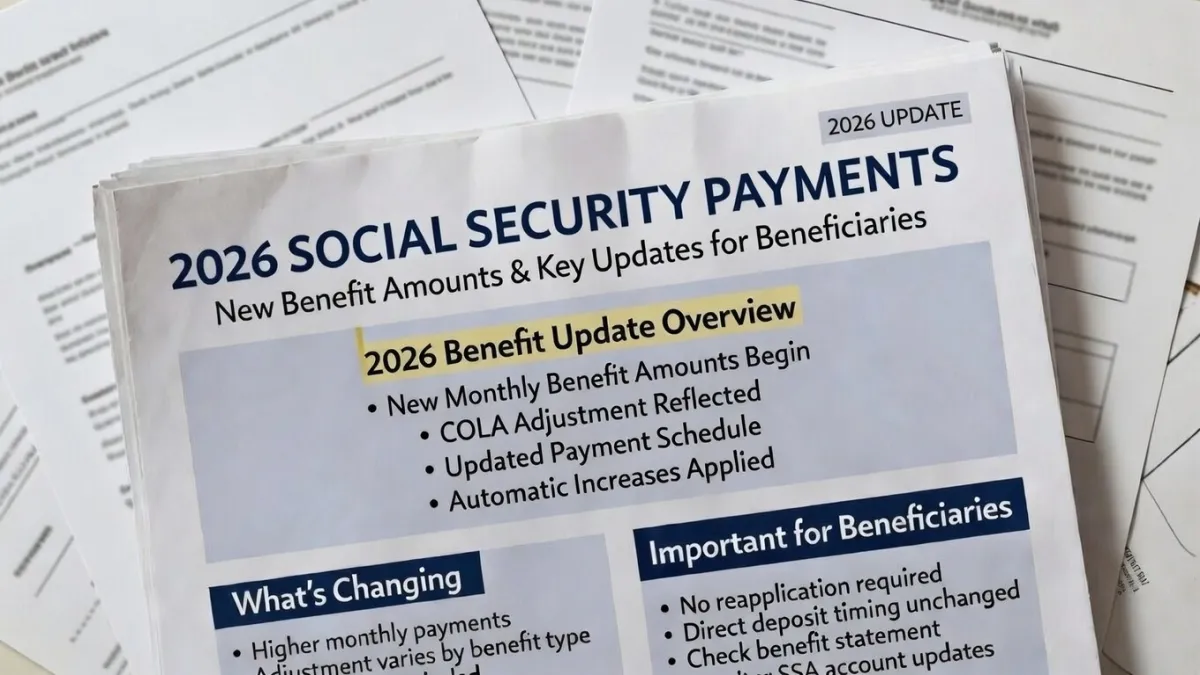

The first Social Security payments of 2026 have started arriving in bank accounts across the United States. For millions of retirees and individuals receiving disability benefits, these monthly payments are a primary source of income. The January deposit is especially important because it includes the updated cost-of-living adjustment and any new deductions that take effect at the beginning of the year. Many recipients review their first payment carefully to confirm that the correct revised amount has been deposited.

Each January payment reflects official updates that apply for the new year. One of the most significant changes is the annual cost-of-living adjustment, commonly known as COLA. This increase is designed to help benefits keep pace with inflation. When the cost of goods and services rises, the adjustment helps protect the purchasing power of Social Security income. Even a modest increase can help cover higher grocery prices, utility bills, and medical expenses.

How the Cost-of-Living Adjustment Works

The cost-of-living adjustment is calculated based on national inflation data. When inflation rises, Social Security benefits are increased by a percentage that reflects those changes. The adjustment applies to retirement, disability, and survivor benefits. Because each person’s benefit is based on their lifetime earnings record and work history, the actual dollar increase differs from one recipient to another.

For example, someone receiving a larger monthly benefit may see a higher dollar increase compared to someone receiving a smaller benefit. The percentage increase is the same, but the total amount added varies based on the original payment. This is why two people may experience different changes even though the adjustment rate is identical.

Payment Schedule and Timing

The Social Security Administration follows a structured schedule when distributing monthly payments. Individuals who began receiving benefits before May 1997 are usually paid near the beginning of each month. Most other recipients receive payments according to their birth date.

Beneficiaries born between the first and tenth of the month typically receive payment on the second Wednesday. Those born between the eleventh and twentieth are generally paid on the third Wednesday. Individuals born after the twentieth usually receive payment on the fourth Wednesday. If a payment date falls on a weekend or federal holiday, the deposit is often moved to the nearest business day before the scheduled date. This organized system allows the agency to process millions of payments efficiently.

Why the Net Deposit May Look Different

Some recipients may notice that the amount deposited into their bank account is slightly lower than expected. This does not necessarily mean there is an error. Certain deductions are taken directly from Social Security benefits before the final deposit is issued. Medicare Part B premiums are one of the most common deductions.

If Medicare costs increase at the start of the year, part of the cost-of-living adjustment may be offset by higher premiums. This can result in a net payment that feels smaller than anticipated. Reviewing both the gross benefit amount and the final deposit can help explain the difference.

Other Factors That Can Affect Payments

Personal circumstances may also influence benefit amounts. Earnings from part-time employment, updates to income records, or changes in marital status can affect calculations. Disability beneficiaries may also experience periodic reviews that could lead to adjustments. Reporting changes to the Social Security Administration in a timely manner helps prevent future corrections or overpayments.

The January payment often sets the financial foundation for the rest of the year. Once the updated amount is confirmed, most monthly payments remain consistent unless personal details change. Reviewing statements early provides reassurance and helps individuals plan their annual budgets more effectively.

Disclaimer: This article is for informational purposes only and does not provide legal or financial advice. Social Security benefit amounts, deductions, and payment schedules vary based on individual circumstances and official policies. For accurate and personalized information, consult official Social Security Administration resources or contact SSA directly.